The insurance industry, a sector built on trust, risk management, and precise calculations, faces a unique set of challenges in today’s rapidly evolving digital landscape. From managing complex policy portfolios to accurately calculating premiums based on a multitude of factors, efficiency and accuracy are paramount. Legacy systems, often fragmented and outdated, struggle to keep pace with the demands of modern insurance operations. This is where Enterprise Resource Planning (ERP) systems come into play, offering a comprehensive solution to streamline processes, improve data visibility, and ultimately, enhance profitability.

Implementing an ERP system in the insurance sector is not merely about upgrading technology; it’s about fundamentally transforming the way business is conducted. It’s about breaking down silos between departments, automating manual tasks, and empowering employees with real-time insights. However, the journey to ERP adoption can be complex, fraught with potential pitfalls if not approached strategically. Choosing the right system, customizing it to meet specific needs, and ensuring seamless integration with existing infrastructure are crucial for success. The potential rewards, however, are substantial: improved operational efficiency, enhanced customer satisfaction, and a competitive edge in a dynamic market.

This article delves into the world of ERP systems for insurance premium and policy management. We’ll explore the key features and benefits, examine the common challenges encountered during implementation, and provide practical guidance on selecting the optimal ERP solution for your insurance organization. Drawing from real-world experiences and best practices, we aim to equip you with the knowledge necessary to navigate the complexities of ERP adoption and unlock its transformative potential for your business. Think of this as a roadmap, guiding you through the process from initial assessment to successful implementation and beyond.

Understanding the Role of ERP in Insurance

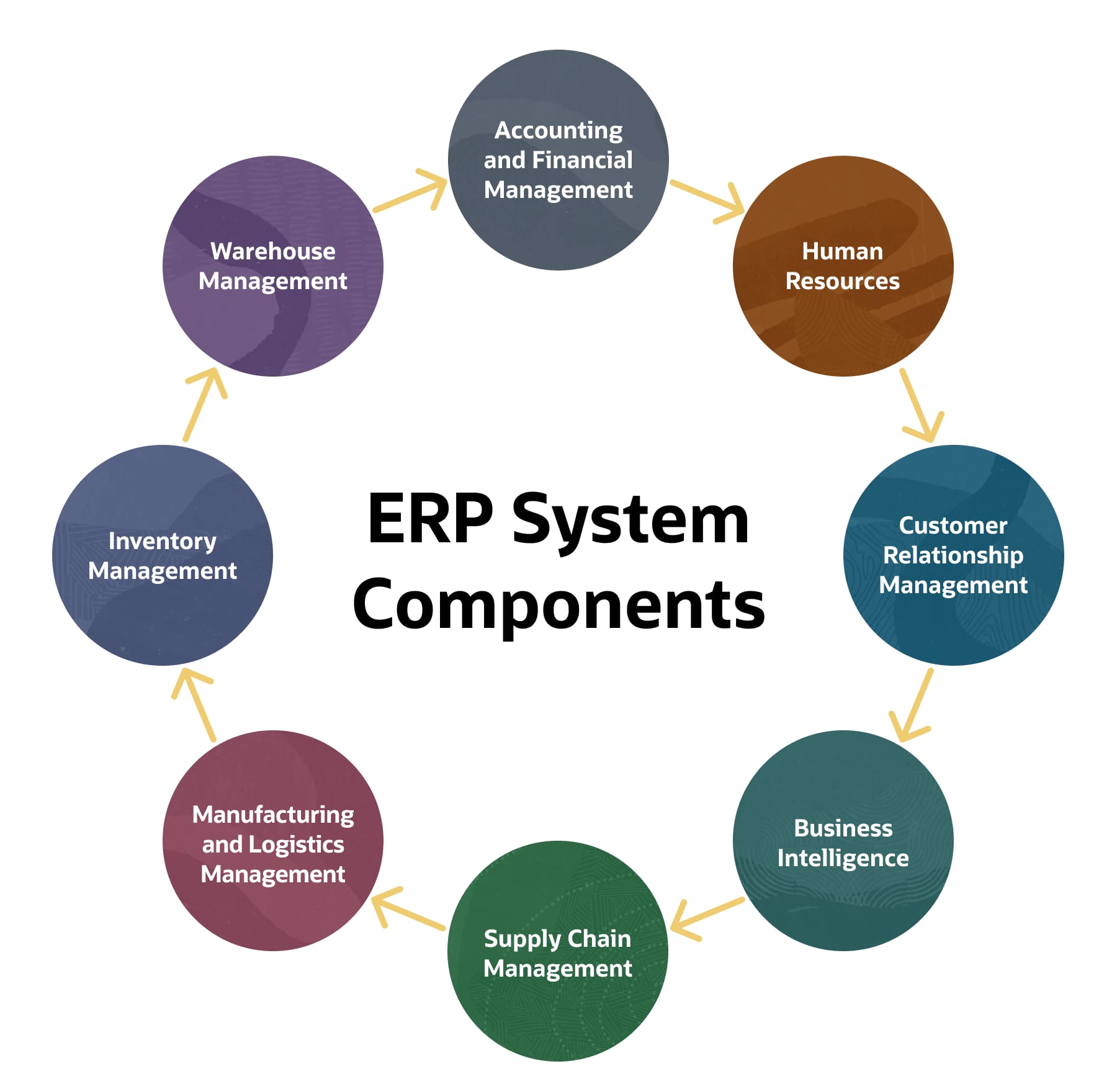

ERP systems, traditionally associated with manufacturing and supply chain management, have found increasing relevance in the insurance industry. Their ability to integrate various business functions into a single, unified platform makes them ideally suited to address the complex operational requirements of insurance companies. At its core, an ERP system acts as a central repository for all critical business data, providing a single source of truth for decision-making.

Core Modules and Functionality

An ERP system designed for insurance premium and policy management typically includes several key modules, each addressing a specific aspect of the business:

- Policy Administration: This module manages the entire policy lifecycle, from initial quote generation to policy issuance, renewal, and cancellation. It handles policy terms, conditions, coverage details, and endorsements.

- Premium Management: This module automates premium calculation, billing, collection, and reconciliation. It supports various payment methods and manages premium adjustments based on risk factors and customer behavior.

- Claims Management: This module streamlines the claims process, from initial claim submission to investigation, settlement, and payment. It facilitates efficient communication between adjusters, claimants, and other stakeholders.

- Reinsurance Management: This module manages reinsurance agreements, including treaty and facultative reinsurance. It tracks reinsurance premiums, claims recoveries, and financial reporting.

- Financial Management: This module provides comprehensive financial reporting and analysis capabilities, including general ledger, accounts payable, accounts receivable, and budgeting.

- Customer Relationship Management (CRM): This module helps manage customer interactions, track customer inquiries, and personalize customer service. It provides a 360-degree view of the customer relationship.

- Reporting and Analytics: This module provides real-time insights into key performance indicators (KPIs), enabling data-driven decision-making. It generates reports on policy performance, premium revenue, claims trends, and other critical metrics.

Benefits of Implementing an ERP System

Implementing an ERP system offers numerous benefits for insurance companies, including:

- Increased Efficiency: Automation of manual tasks reduces errors and frees up employees to focus on higher-value activities.

- Improved Data Visibility: A centralized database provides a single source of truth, enabling better decision-making and risk management.

- Enhanced Customer Service: Streamlined processes and improved communication lead to faster response times and increased customer satisfaction.

- Reduced Costs: Automation and efficiency gains lead to lower operational costs and improved profitability.

- Improved Compliance: ERP systems help insurance companies comply with regulatory requirements by providing audit trails and ensuring data accuracy.

- Better Risk Management: Enhanced data visibility and analytics enable better risk assessment and mitigation.

Common Challenges During ERP Implementation

While the benefits of ERP implementation are significant, the process is not without its challenges. Careful planning and execution are essential to mitigate these risks and ensure a successful outcome. Having been through a few implementations myself, I can tell you that expecting the unexpected is key.

Data Migration

Migrating data from legacy systems to the new ERP system can be a complex and time-consuming process. Data cleansing, transformation, and validation are crucial to ensure data accuracy and consistency. Poor data migration can lead to inaccurate reporting, flawed decision-making, and operational disruptions. This is often underestimated, so allocate ample time and resources to this phase.

Customization and Integration

Insurance companies often require customizations to the ERP system to meet their specific business needs. Integrating the ERP system with existing systems, such as policy administration platforms or claims management systems, can also be challenging. Excessive customization can increase implementation costs and complexity, while poor integration can lead to data silos and inefficiencies.

User Adoption

Getting employees to embrace the new ERP system can be a significant challenge. Resistance to change, lack of training, and poor communication can hinder user adoption. Comprehensive training programs, clear communication, and strong leadership support are essential to ensure successful user adoption. Remember, people are the most important part of any technology implementation.

Cost Overruns and Delays

ERP implementations can be expensive and time-consuming. Unexpected issues, scope creep, and poor project management can lead to cost overruns and delays. Careful planning, realistic budgeting, and effective project management are crucial to keep the project on track and within budget.

Insufficient Planning

One of the biggest pitfalls is a lack of thorough planning. This includes not clearly defining business requirements, failing to adequately assess existing processes, and not identifying potential risks. A detailed project plan, with clearly defined goals, timelines, and responsibilities, is essential for success. Don’t skip the discovery phase!

Choosing the Right ERP Solution

Selecting the right ERP solution is a critical decision that can significantly impact the success of the implementation. Several factors should be considered when evaluating different ERP systems.

Industry-Specific Functionality

Choose an ERP system that is specifically designed for the insurance industry and includes the necessary modules and functionality to support your business processes. A generic ERP system may require extensive customization, which can increase costs and complexity.

Scalability and Flexibility

Select an ERP system that can scale to meet your growing business needs and adapt to changing market conditions. The system should be flexible enough to accommodate future customizations and integrations. If you’re seeking to streamline operations and enhance customer relationships, Top Crm Apps can be invaluable tools for achieving those goals

Vendor Reputation and Support

Choose a reputable ERP vendor with a proven track record of successful implementations in the insurance industry. Ensure that the vendor provides adequate support and training to help you get the most out of the system. Check references and talk to other insurance companies that have implemented the same ERP system.

Total Cost of Ownership

Consider the total cost of ownership, including software licenses, implementation services, hardware, training, and ongoing maintenance. Compare the costs of different ERP systems and choose the one that provides the best value for your money. Don’t just look at the initial purchase price; consider the long-term costs.

Cloud vs. On-Premise Deployment

Decide whether to deploy the ERP system in the cloud or on-premise. Cloud-based ERP systems offer several advantages, including lower upfront costs, easier maintenance, and greater scalability. However, on-premise ERP systems may provide greater control over data security and customization. This really depends on your company’s internal IT capabilities and risk tolerance.

Integration Capabilities

Ensure the ERP system can integrate seamlessly with your existing systems, such as policy administration platforms, claims management systems, and CRM systems. Integration is crucial for data consistency and operational efficiency.

Best Practices for Successful ERP Implementation

To maximize the chances of a successful ERP implementation, consider the following best practices:

Executive Sponsorship

Secure strong executive sponsorship to drive the project forward and ensure that it receives the necessary resources and support. Executive buy-in is critical for overcoming resistance to change and ensuring user adoption.

Detailed Project Planning

Develop a detailed project plan with clearly defined goals, timelines, and responsibilities. Use project management tools and techniques to track progress and manage risks.

Change Management

Implement a comprehensive change management program to prepare employees for the new ERP system and address their concerns. Communicate the benefits of the system and provide adequate training to ensure successful user adoption. Understanding your business needs is crucial before you evaluate Best Crm Platforms

Data Governance

Establish a data governance framework to ensure data accuracy, consistency, and security. Define data ownership, establish data quality standards, and implement data validation procedures.

Testing and Training

Conduct thorough testing of the ERP system before go-live to identify and resolve any issues. Provide comprehensive training to all users to ensure they are proficient in using the system.

Continuous Improvement

Continuously monitor the performance of the ERP system and identify opportunities for improvement. Implement regular updates and upgrades to keep the system up-to-date and optimize its functionality.

In conclusion, ERP systems offer a powerful solution for insurance companies seeking to streamline premium and policy management, improve operational efficiency, and enhance customer satisfaction. By carefully planning the implementation, choosing the right solution, and following best practices, insurance companies can unlock the transformative potential of ERP and gain a competitive edge in today’s dynamic market. It’s an investment that, when done right, can pay dividends for years to come.

Frequently Asked Questions (FAQ) about ERP Systems for Insurance Premium and Policy Management

How can implementing an ERP system specifically improve the efficiency of insurance premium calculation and policy management processes?

Implementing an ERP system significantly enhances the efficiency of insurance premium calculation and policy management by centralizing data and automating key processes. An ERP integrates various departments and functions, such as sales, underwriting, finance, and claims, allowing for a unified view of customer data and policy information. This integration eliminates data silos and reduces manual data entry, minimizing errors and saving time. Furthermore, ERP systems often include built-in rules engines that automatically calculate premiums based on pre-defined factors and regulatory requirements. The system also streamlines policy issuance, renewal, and cancellation processes, leading to faster turnaround times and improved customer satisfaction. Real-time reporting and analytics capabilities provide valuable insights into premium trends, policy performance, and risk assessment, enabling insurers to make data-driven decisions and optimize their operations. Many insurance providers are exploring new technological solutions, and Erp Platforms Insurance are becoming increasingly vital for streamlined operations and enhanced customer service

What are the key features I should look for in an ERP system designed for insurance companies focusing on premium processing, policy administration, and claims management?

When selecting an ERP system for an insurance company, especially one focused on premium processing, policy administration, and claims management, several key features are crucial. First, look for robust premium calculation capabilities, including support for various insurance products and risk factors. Policy administration features should include automated policy issuance, renewal, and endorsement processes, as well as efficient document management. Claims management functionality should facilitate claims submission, adjudication, and payment processing. Integration with actuarial systems is also valuable for accurate risk assessment. Furthermore, the ERP should offer comprehensive reporting and analytics tools to track key performance indicators (KPIs) related to premiums, policies, and claims. Compliance features that support regulatory requirements, such as those related to data privacy and financial reporting, are also essential. Scalability and flexibility are important to accommodate future growth and changing business needs.

What are the potential challenges and risks involved in implementing an ERP system for insurance premium and policy management, and how can these be mitigated?

Implementing an ERP system for insurance premium and policy management presents several potential challenges and risks. One major challenge is the complexity of integrating the ERP with existing legacy systems, which can lead to data migration issues and system incompatibility. Resistance to change from employees accustomed to older processes is another common hurdle. Other risks include budget overruns, project delays, and inadequate training, which can hinder user adoption. To mitigate these risks, a well-defined implementation plan is crucial. This plan should include a thorough assessment of existing systems, a clear scope of work, and a realistic budget and timeline. Effective communication and change management strategies are essential to address employee concerns and ensure buy-in. Comprehensive training programs should be provided to equip users with the necessary skills to utilize the new ERP system effectively. Thorough testing and data validation are also critical to ensure data accuracy and system stability. Engaging experienced consultants can provide valuable expertise and guidance throughout the implementation process.