In the fast-paced world of insurance, managing customer relationships effectively is paramount. Insurance agencies deal with a vast amount of client data, from policy details and claims history to personal information and communication logs. Juggling this information manually can lead to inefficiencies, errors, and ultimately, dissatisfied customers. This is where Customer Relationship Management (CRM) systems come into play, offering a centralized and streamlined solution for managing customer data and enhancing overall agency operations.

A well-implemented CRM system can revolutionize how an insurance agency interacts with its clients. It provides a 360-degree view of each customer, enabling agents to personalize their interactions, anticipate their needs, and provide exceptional service. By automating routine tasks, CRM systems free up agents to focus on building relationships and closing deals. The benefits extend beyond customer service, impacting sales, marketing, and overall business growth.

This article delves into the specifics of how CRM helps insurance agencies manage customer data, exploring the key features, benefits, and best practices for leveraging these powerful tools. We’ll examine how CRM can streamline processes, improve communication, and ultimately contribute to a more profitable and customer-centric insurance business. From lead management to policy renewals, we’ll cover the essential aspects of using CRM to its full potential in the insurance industry.

Understanding the Core Functionality of CRM for Insurance

At its core, a CRM system acts as a central repository for all customer-related information. For insurance agencies, this means storing everything from basic contact details to complex policy information and claims history. This centralized database enables agents to access the information they need quickly and easily, regardless of where they are or what device they’re using.

Centralized Data Management

The foundation of any good CRM system is its ability to centralize customer data. Instead of scattered spreadsheets, paper files, or disparate systems, all information is stored in a single, accessible location. This eliminates data silos, reduces the risk of errors, and ensures that everyone in the agency is working with the same, up-to-date information. This includes:

- Contact information (name, address, phone number, email)

- Policy details (type of policy, coverage amounts, premiums, effective dates)

- Claims history (dates, amounts, status)

- Communication logs (emails, phone calls, meeting notes)

- Lead source and marketing campaign information

Lead Management and Tracking

CRM systems are crucial for managing leads and tracking their progress through the sales pipeline. Agents can capture leads from various sources, such as website forms, referrals, or marketing campaigns, and then track their interactions with each lead. This allows them to identify promising prospects and prioritize their efforts accordingly. Features like automated lead scoring can further streamline the process by identifying the leads most likely to convert.

Policy Management and Renewal Reminders

Managing policy information and ensuring timely renewals is a critical function for insurance agencies. CRM systems can automate many of the tasks associated with policy management, such as sending renewal reminders, generating policy documents, and tracking policy changes. This not only saves time and reduces errors but also helps ensure that customers remain covered and avoid lapses in coverage. Finding the right solution for your business needs often involves comparing various systems, so understanding what makes Best Erp Software truly excel becomes paramount

Reporting and Analytics

CRM systems provide powerful reporting and analytics capabilities that allow insurance agencies to track key performance indicators (KPIs) and gain insights into their business. This includes reports on sales performance, lead conversion rates, customer retention rates, and marketing campaign effectiveness. By analyzing this data, agencies can identify areas for improvement and make data-driven decisions to optimize their operations.

Benefits of Using CRM in Insurance Agencies

Implementing a CRM system offers a multitude of benefits for insurance agencies, ranging from improved customer service to increased sales and efficiency. Here are some of the key advantages:

Improved Customer Service

By providing a 360-degree view of each customer, CRM systems empower agents to deliver personalized and efficient customer service. Agents can quickly access customer information, understand their needs, and respond to inquiries promptly. This leads to higher customer satisfaction and increased loyalty. Imagine being able to instantly see a customer’s policy details, claims history, and past interactions before even answering the phone – that’s the power of CRM.

Increased Sales and Revenue

CRM systems can help insurance agencies increase sales and revenue by improving lead management, streamlining the sales process, and identifying upselling and cross-selling opportunities. By tracking lead interactions and identifying promising prospects, agents can focus their efforts on closing deals. Furthermore, CRM can help agents identify customers who may be interested in additional coverage or different types of policies, leading to increased revenue.

Enhanced Efficiency and Productivity

CRM systems automate many of the routine tasks associated with managing customer data, such as sending renewal reminders, generating reports, and tracking lead interactions. This frees up agents to focus on more strategic activities, such as building relationships and closing deals. The time saved through automation translates directly into increased efficiency and productivity.

Better Communication and Collaboration

CRM systems facilitate better communication and collaboration within the agency by providing a centralized platform for sharing information and tracking interactions. Agents can easily share notes, documents, and updates with each other, ensuring that everyone is on the same page. This is especially important in larger agencies where multiple agents may be working with the same customer.

Data-Driven Decision Making

The reporting and analytics capabilities of CRM systems provide insurance agencies with valuable insights into their business. By tracking KPIs and analyzing trends, agencies can make data-driven decisions to optimize their operations, improve customer service, and increase sales. For example, an agency might use CRM data to identify the most effective marketing channels or to identify areas where customer service is lacking. For businesses seeking streamlined operations, evaluating Top Erp Platforms is a crucial step

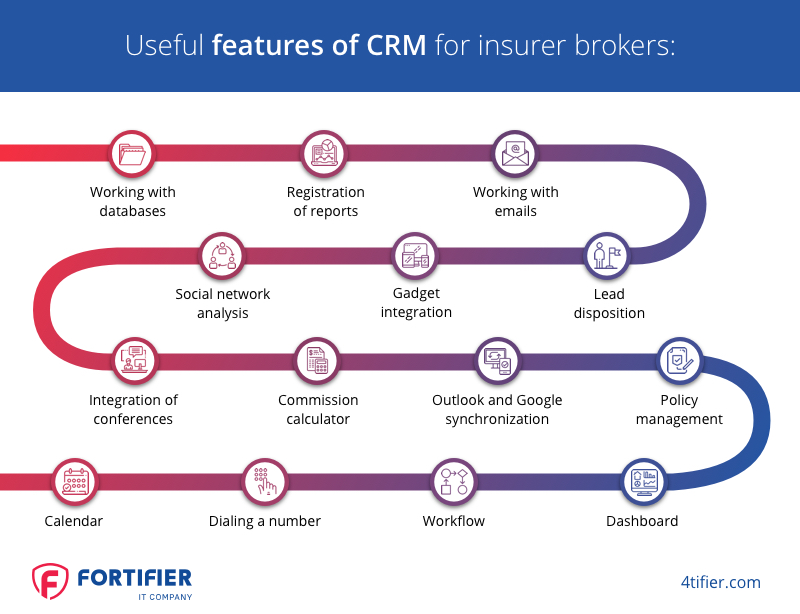

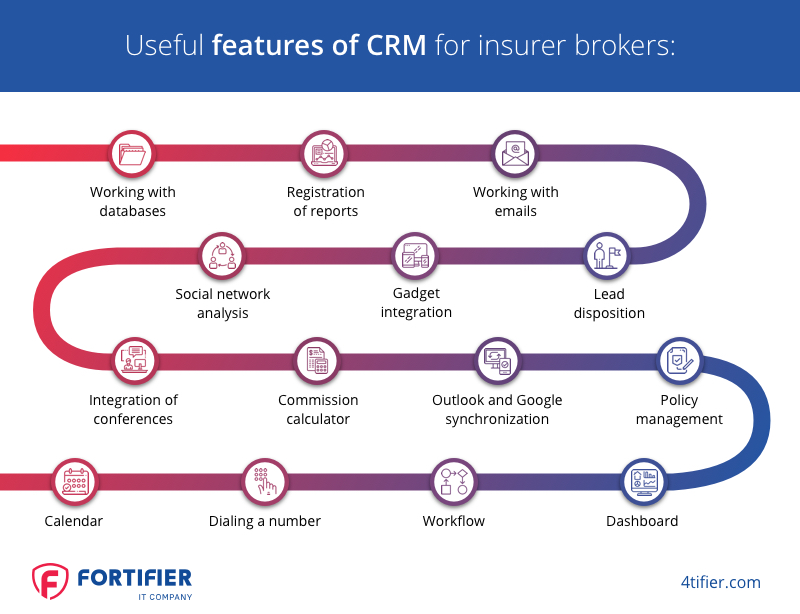

Key Features to Look for in a CRM for Insurance

When choosing a CRM system for your insurance agency, it’s important to consider the specific features that are most important to your business. Here are some key features to look for:

Policy Management

A robust policy management module is essential for insurance agencies. This should allow you to easily track policy details, manage renewals, and generate policy documents. Look for features like automated renewal reminders and integration with insurance carriers.

Claims Management

The ability to track and manage claims is another critical feature. This should allow you to record claim details, track the status of claims, and communicate with customers about their claims. Integration with claims processing systems can further streamline the process.

Lead Management and Marketing Automation

Effective lead management and marketing automation tools are essential for attracting and converting new customers. Look for features like lead scoring, email marketing, and integration with social media platforms.

Reporting and Analytics

A comprehensive reporting and analytics module is crucial for tracking KPIs and gaining insights into your business. Look for features like customizable dashboards, pre-built reports, and the ability to export data for further analysis.

Integration with Other Systems

The CRM system should integrate seamlessly with your other business systems, such as your accounting software, email platform, and phone system. This will help to streamline your workflow and reduce data entry errors.

Implementing a CRM System: Best Practices

Implementing a CRM system can be a significant undertaking, but following these best practices can help ensure a successful implementation:. Managing customer relationships is vital, and Crm Erp Insurance can streamline operations and improve policyholder satisfaction

Define Your Goals and Objectives

Before you start evaluating CRM systems, take the time to define your goals and objectives. What do you hope to achieve by implementing a CRM system? Do you want to improve customer service, increase sales, or streamline your operations? Having clear goals will help you choose the right CRM system and measure your success.

Choose the Right CRM System

There are many different CRM systems available, so it’s important to choose one that meets your specific needs and budget. Consider the features that are most important to your business, as well as the cost of the system and the level of support that is provided. Don’t be afraid to request demos and try out different systems before making a decision.

Train Your Staff

Once you’ve chosen a CRM system, it’s important to train your staff on how to use it effectively. Provide comprehensive training on all of the key features and functions of the system. Consider offering ongoing training to ensure that your staff stays up-to-date on the latest features and best practices.

Customize the System

Most CRM systems can be customized to meet the specific needs of your business. Take the time to customize the system to reflect your workflows and processes. This will make the system more user-friendly and help to ensure that your staff uses it effectively.

Monitor and Evaluate

After you’ve implemented your CRM system, it’s important to monitor and evaluate its performance. Track your KPIs and identify areas where you can improve. Regularly review your CRM strategy and make adjustments as needed to ensure that you’re getting the most out of your system.

Conclusion

In conclusion, a CRM system is an indispensable tool for insurance agencies looking to effectively manage customer data, improve customer service, and increase sales. By centralizing customer information, automating routine tasks, and providing valuable insights, CRM systems empower agencies to deliver a superior customer experience and drive business growth. By carefully selecting the right CRM system, implementing it effectively, and training your staff properly, you can unlock the full potential of CRM and transform your insurance agency into a more customer-centric and profitable organization.

Frequently Asked Questions (FAQ) about How CRM Helps Insurance Agencies Manage Customer Data

How can a CRM system help insurance agencies improve customer data management and lead nurturing efficiency?

A CRM (Customer Relationship Management) system significantly improves customer data management and lead nurturing efficiency for insurance agencies. By centralizing all customer information – including contact details, policy history, communication logs, and claims data – a CRM provides a 360-degree view of each client. This allows agents to personalize interactions and provide more relevant advice. Automated workflows within the CRM can trigger follow-up reminders for policy renewals, cross-selling opportunities, and addressing outstanding inquiries. This ensures no lead is forgotten and improves the chances of converting prospects into loyal customers. Furthermore, reporting features allow agencies to analyze data, identify trends, and optimize their sales and marketing strategies for better results.

What are the key benefits of using a CRM for insurance agencies specifically when it comes to policy tracking and renewal management?

For insurance agencies, a CRM offers several key benefits related to policy tracking and renewal management. First, it provides a centralized repository for all policy information, eliminating the need for scattered spreadsheets and paper files. This ensures easy access to policy details, coverage amounts, and expiration dates. Second, the CRM can automate renewal reminders, sending timely notifications to both agents and clients. This proactive approach helps prevent policy lapses and improves customer retention. Third, the system can track client interactions related to renewals, providing agents with a clear understanding of client needs and concerns. Finally, CRM reporting features provide insights into renewal rates and potential areas for improvement in the renewal process, enabling the agency to optimize their strategies for greater success.

How does using a CRM for insurance sales help in improving customer communication and personalization of insurance offerings?

A CRM enhances customer communication and personalization of insurance offerings by providing agents with a comprehensive understanding of each client’s needs and preferences. With all customer data readily available, agents can tailor their communication style and content to resonate with individual clients. The CRM enables segmentation of customer lists based on demographics, policy types, or other relevant criteria, allowing for targeted marketing campaigns. Automated email marketing features allow agents to send personalized messages with relevant information and offers. By leveraging the data stored in the CRM, agents can identify cross-selling and upselling opportunities, recommending insurance products that align with the client’s specific circumstances. This level of personalization fosters stronger customer relationships and drives increased sales.